“...a simple way to improve profitability and still offer the convenience of credit.”

David Crawford • David Crawford, HealthMarkets Insurance Agency

Are you ready to eliminate

your credit card processing fees?

If you have ever paid for fuel at a gas pump,

You are probably

familiar with Dual Pricing.

Across the U.S., gas stations have offered both cash and credit pricing for decades now.

Limitations in software and POS equipment have made dual pricing models complicated for merchants in the past.

Resolute Payments utilizes the latest in POS equipment and software to allows for merchants of all industries to offer this same, great cash discount program to their customers.

This same pricing model is now available through

See how it works

in 3 easy steps

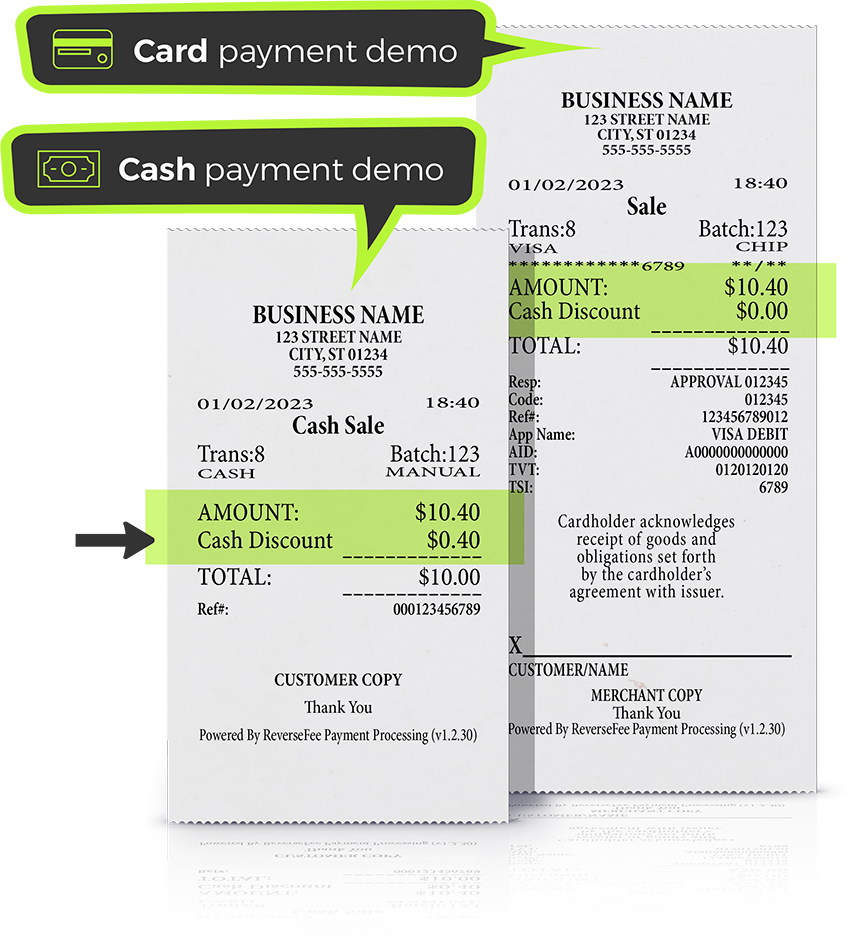

Our terminals automatically apply and display a discount* to all cash sales. *typically 4%

Our Dual Pricing program allows business owners to offer two different transaction amounts to customers paying with cash vs. paying by credit card. The two separate prices are clearly displayed on the terminal and PIN pad showing the customer the discount applied when paying with cash. If a customer pays with a card, the discount is not applied.

The way this works is that the customer pays a small service fee when using a card to purchase goods or services from your business. ReverseFee Payment Processing uses this small fee to cover all transaction and support costs. You will receive the full transaction amount for every sale, and at the end of the month, there are no fees on your statement.

You keep up to 100% of your profit!

Dual Pricing has been a proven solution to help business owners offset the following cost of doing business:

- Your processor taking 3-4% of your debit & credit card sales.

- Increasing credit card rates and junk fees

- Paying for your customer’s incentives like airline miles, cash back, rewards, etc.

- Losing customers because of your “Credit Card Minimum” signs

- Growing employee minimum wages

- Growing cost of goods due to inflation

Start eliminating your payment processing fees and put those savings back into growing your business.

Savings Calculator

Swipe the card below to select your

Your annual credit card processing volume

See how much

you can Save

*Projected savings based on 3% processing fee X’s annual credit card processing volume

Offers the following solutions:

- Next day funding until 11:00 PM (EST)

- POS Systems for all business types

- Pay at the table Wi-Fi / Wireless terminals

- EBT and EMV enabled equipments

- 100% compliance with all state laws [Learn More]

- All major contactless payments supported